Subscribe for Latest Updates

The State Comptroller’s office is committed to keeping New Yorkers regularly updated on the state’s economy and finances. Subscribe to get the latest update.

September 2, 2020 Edition

Selected Economic Trends

Statewide, 28% of Lost Jobs Have Been Regained Through July; in NYC, 17%

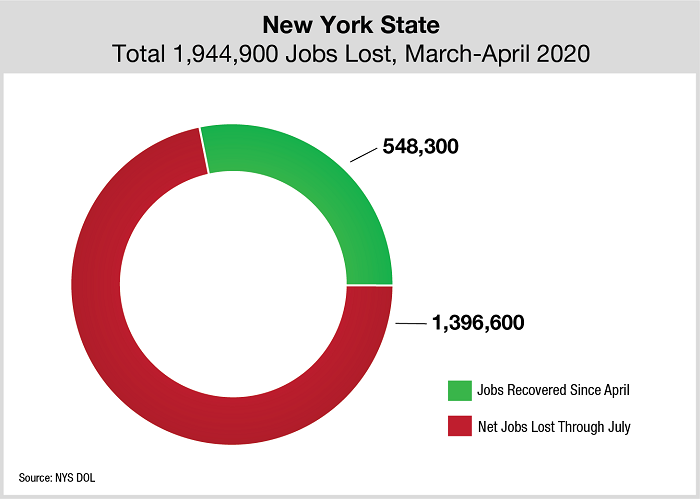

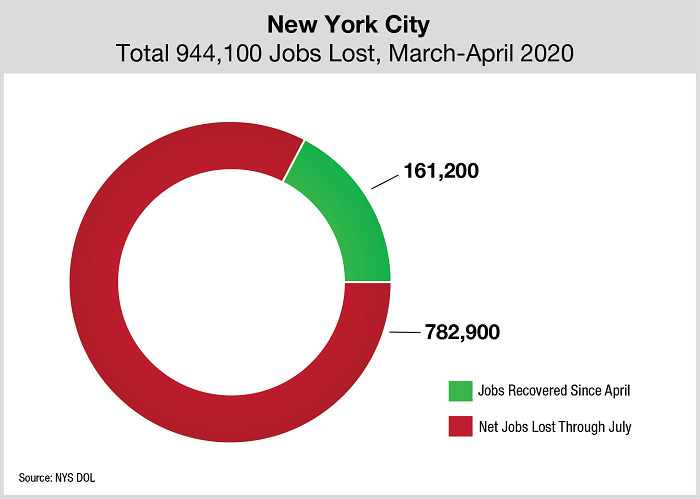

While New York State has regained more than one in four of the jobs it lost in March and April, the unprecedented scale of losses due to the COVID-19 pandemic leaves a daunting path ahead for the State to climb back to pre-recession employment levels. For New York City, the picture is even more troubling.

New York State’s job count fell by more than 1.9 million in March and April. Through July, the State had regained 548,000 jobs, or 28 percent, as shown below.

The COVID-19 recession cost New York City 944,100 jobs in March and April, nearly half the statewide total. Since then, the City has regained 161,000, or 17 percent – with most of the gains (101,000) occurring in June.

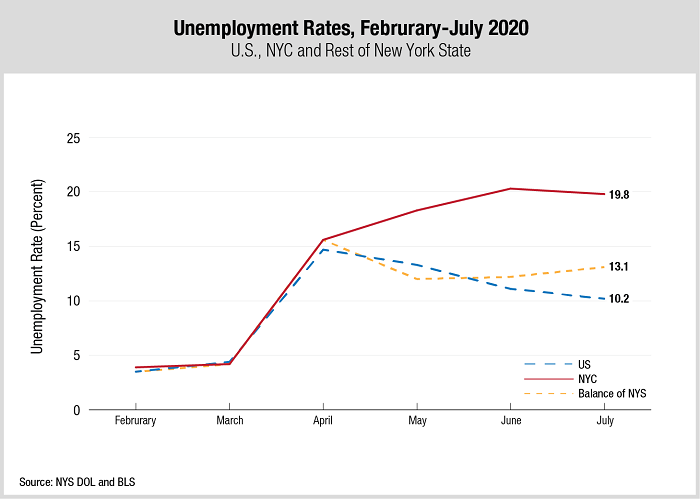

Throughout New York State and nationally, unemployment rates spiked upward in April, as shown below. Since then, unemployment has moderated noticeably both for the nation and for the State outside New York City. However, the City’s unemployment rate in July (latest figures available) remained several points above its April level.

Small Businesses in New York Hit Especially Hard by COVID-19

Forty-five percent of small businesses in New York State have experienced a large negative effect from the coronavirus pandemic, according to a U.S. Census Bureau survey during the week ending August 22. New York’s share was the second-highest among the states, 12 percentage points above the national average. Another 41 percent of New York small businesses reported moderate negative effects from the pandemic, while 5 percent experienced positive effects, and only 10 percent said the pandemic had little or no impact. (Reported percentages are rounded to the nearest whole number; the Census Bureau does not define elements of negative or positive impacts.)

Other survey results related to business operations include:

- Half of New York small business respondents indicated they have paid employees who work from home.

- One-quarter have seen operating capacity (maximum amount of activity possible under realistic operating conditions) decline by half or more from a year ago; another 35 percent saw smaller declines. Most of the remaining businesses saw no change.

- 18 percent of respondents reported having either no cash on hand for business operations, or only enough for two weeks or less. Another 17 percent reported having enough for three to four weeks; and 24 percent had cash adequate for one to two months.

Looking Ahead

Over half of New York State small businesses believe that more than six months will pass before the business returns to its normal level of operations relative to a year ago, and 11 percent believe their businesses will never return to normal, the survey found.

On a more positive note, New York is also a leader among the states in the proportion of small businesses with recent rehirings. During the week ended August 22, 11 percent of small businesses in New York reported rehiring employees who had been furloughed or laid off after March 13 of this year – compared to 6 percent nationally. Due to survey limitations, data for more than a third of the states are not included in the Census Bureau results for this question.

New York State’s Budget

The State’s General Fund balance was $12.8 billion as of August 28, compared to $14.4 billion on July 31. Factors contributing to that balance include:

- $4.5 billion in proceeds of short-term borrowing that the Division of the Budget anticipates repaying before the end of the fiscal year; and

- More than $1.9 billion in withheld payments due to local governments, nonprofit organizations and others. Whether or when these payments will be made remains uncertain.

The federal CARES Act provided $5.1 billion to New York State through the Coronavirus Relief Fund. As of August 28, the State’s CARES Act Fund held a balance of just under $4 billion. A total of $1.1 billion had been spent as of that date, including:

- $797 million for non-personal service costs, mostly through the Department of Health; and

- $232 million for personal services and fringe benefits, both primarily for the State Police.

Unemployment insurance payments totaling nearly $41.8 billion have been processed by the Office of the State Comptroller, working with the State Department of Labor, since March 1. After peaking at more than $3.5 billion in early June, more recent weekly totals of such payments have declined but remained above $1 billion, still far above typical historical levels.

Census 2020: Deadline Approaching

The deadline for completing the 2020 Census has been moved up to September 30, 2020. The decennial Census determines each state’s representation in Congress and influences federal spending for education, public transit systems, community development and other essential programs. An accurate count is critical for our State’s future; for more details, see this Census 2020 section of the Comptroller’s website. New Yorkers can respond today via the Census Bureau’s online response form.