State Comptroller Thomas P. DiNapoli released a report today, which found 27 local governments are three or more years delinquent in meeting one or more annual financial reporting requirements.

“While the vast majority of local governments complete their financial filings as required, giving stakeholders information they can use to make financial decisions, a number do not,” DiNapoli said. “Failing to file for three or more years calls into question the financial position of the locality as well as the effectiveness of the local government’s financial management. When a local government fails to keep this public information current and accessible, it undermines confidence and accountability.”

In addition to meeting legal requirements, local governments and their residents benefit from timely filing because the information reflected in the reports increases the transparency of the operations of local governments. State and local policymakers and the public can access this data through the Office of the State Comptroller’s Open Book New York database to better assess the recent and current financial condition of their local governments. The information can also be used by local officials in developing multiyear financial plans, which can help them better handle the difficult budget decisions they make year after year.

Consistency in filings creates a comprehensive financial picture for local officials, citizens, researchers, credit rating agencies, legislators and the media, who each may rely on the data included within these legally required financial reports.

The three filing requirements highlighted in the report are: Annual Financial Reports (AFRs) which are required from all local governments; Constitutional Tax Limit (CTL) forms, which are required from all counties, cities and villages and Property Tax Cap (PTC) reports, which are required from all taxing jurisdictions.

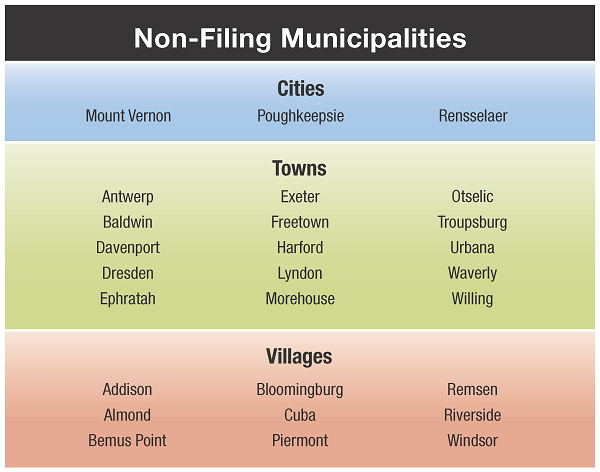

The AFR provides detailed information related to revenues, expenditures, debt, cash reserves and fund balance. There are 20 local governments – two cities (Mount Vernon and Rensselaer), 11 towns and 7 villages – that have not submitted their AFR in at least three years, and the towns of Davenport and Morehouse have not filed for more than 6 years. When examined in total, the last-reported expenditures of these 20 AFR-delinquent local governments amounted to $164.5 million.

The CTL restricts the amount local governments may raise by taxing real estate in any fiscal year. The CTL form captures full valuation and levy information needed to calculate the tax limit. Three local governments – two villages and the City of Poughkeepsie – have failed to file CTL forms for three or more years. The Village of Addison has not filed a CTL form in 15 years, while the Village of Riverside has not filed in eight years. In these cases, little to no information is available about the proximity of these local governments to their CTL.

The PTC limits year-over-year growth in a local government’s tax levy and localities are required to submit the data necessary to calculate the tax levy limit. Five towns and one village have failed to file their Property Tax Cap reports for three or more years. Of these, one town and one village were also delinquent in one of the other two filings described above: the Town of Morehouse is also delinquent in filing its AFR, and the Village of Addison is severely delinquent in filing CTL reports.

Full Report

A Grade of Incomplete: Persistent Non-Filers of Legally Required Local Government Reports

Find out how your government money is spent at Open Book New York. Track municipal spending, the state's 170,000 contracts, billions in state payments and public authority data. Visit the Reading Room for contract FOIL requests, bid protest decisions and commonly requested data.