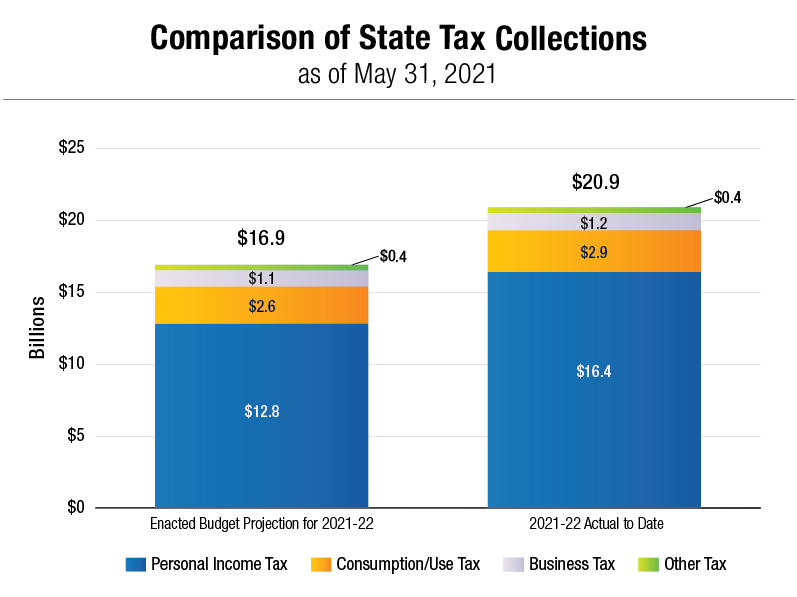

State tax receipts through the first two months of State Fiscal Year (SFY) 2021-22 were $4 billion higher than forecast in the Enacted Budget Financial Plan, according to the monthly State Cash Report released by New York State Comptroller Thomas P. DiNapoli.

“The strong tax collections through the first two months of the state fiscal year is good news and gives reason for optimism about the economic recovery. The state is emerging from the pandemic on solid fiscal footing because of robust tax revenue growth and an unprecedented infusion of federal assistance. Still, economic uncertainties remain and caution is warranted going forward.”

Tax receipts through May totaled $20.9 billion, $14.1 billion more than received in the same period last year, mostly due to a $12.1 billion year-to-year increase in personal income tax (PIT) receipts. Much of this change is attributable to delays in PIT filing deadlines from April 15 to July 15 in 2020, and until May 17 in 2021. In addition, PIT collections increased this year from final returns and extension requests. Year-to-date, consumption and use tax collections were $2.9 billion, 47.4 percent higher than the same period last year.

State Operating Funds spending through May totaled $17.1 billion, which was $4.8 billion, or 38.8 percent, higher than last year for the same period, primarily due to higher Medicaid costs and general state charges. Spending from State Operating Funds was $1.1 billion lower than projected.

As of May 31, the General Fund held a balance of $14.4 billion, $4.7 billion higher than the state Division of Budget projections, and $7 billion higher than last year at the same time.

Find out how your government money is spent at Open Book New York. Track municipal spending, the state's 180,000 contracts, billions in state payments and public authority data. Visit the Reading Room for contract FOIL requests, bid protest decisions and commonly requested data.