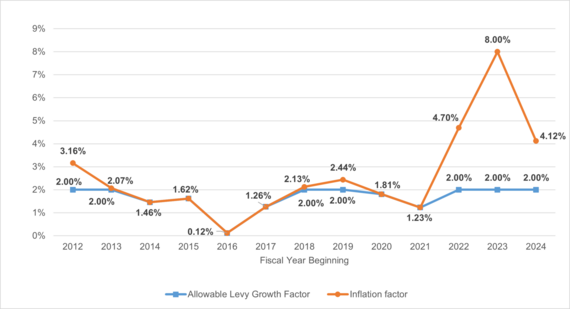

Property tax levy growth for school districts and 10 of the state’s cities will be capped at 2%, the same as last year, according to data released today by State Comptroller Thomas P. DiNapoli.

The tax cap, which first applied to local governments (excluding New York City) and school districts in 2012, limits annual tax levy increases to the lesser of the rate of inflation or 2% with certain exceptions. The law also includes provisions that allow school districts and municipalities to override the cap. DiNapoli’s office calculated the inflation factor at 4.12% for those with a June 30, 2025 fiscal year end.

“While inflation continues to decline from recent highs, it remains well above 2%,” DiNapoli said. “With one-time pandemic relief aid nearly exhausted, school district and municipal officials should carefully monitor cost growth to effectively manage their budgets and ensure they comply with the tax cap law.”

The 2% allowable levy growth affects the tax cap calculations for 676 school districts and 10 cities with fiscal years starting July 1, 2024, including the “Big Four” cities of Buffalo, Rochester, Syracuse and Yonkers.

Allowable Levy Growth and Inflation Factors

Note: Allowable levy growth is expressed as a percentage.

List of allowable tax levy growth factors for all local governments

Property Tax Cap: Inflation and Allowable Levy Growth Factors

Real Property Tax Cap and Tax Cap Compliance web page

https://www.osc.ny.gov/local-government/property-tax-cap