New York’s tourism sector is approaching a complete recovery as visitor spending and related tax revenue have surpassed pre-pandemic levels, according to a new report from New York State Comptroller Thomas P. DiNapoli. The city estimates it will exceed pre-pandemic levels and welcome a record 68 million visitors by 2025.

“The number of tourists is nearly back to pre-pandemic numbers in New York City,” DiNapoli said. “Visitor spending and the tax revenue this industry generates already exceed pre-pandemic levels, but the industry’s recovery won’t be complete until we see a full return of international and business travelers, and a full recovery of local jobs. Our city and state leaders need to focus on keeping New York a desirable and safe destination for individuals and families from around the world.”

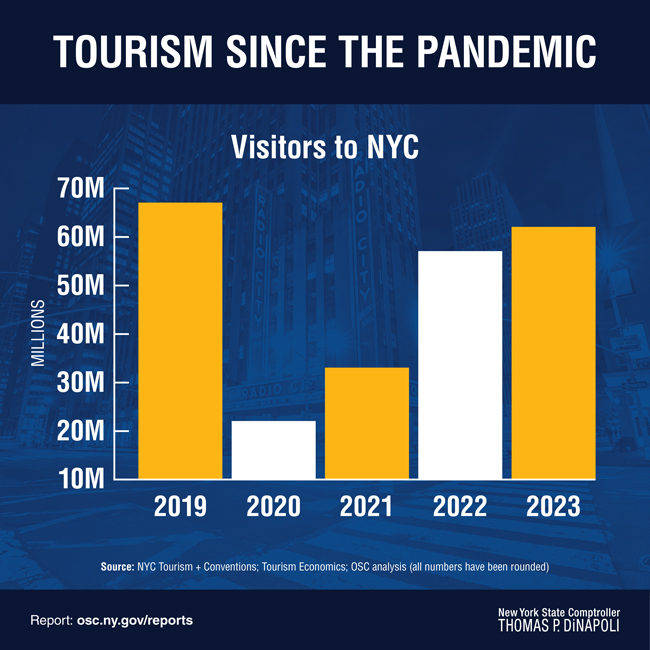

In 2023, 62.2 million people visited New York City, about 7% fewer than the 66.6 million who visited in 2019. Though fewer, these visitors spent over $48 billion in 2023, up 1.3% over 2019, as prices have risen over that time, including average daily hotel room rates, which exceeded $300. The uptick is projected to generate a record $4.9 billion in sales and other tourism-related tax revenue for the city in fiscal year (FY) 2024, a 16% jump since FY 2020. This is significant for the city, as the tourism sector’s record $53.8 billion in economic impact in 2022 accounted for 4.5% of the city’s gross product that year.

Domestic travelers, especially those making leisure trips, have led the city’s tourism sector recovery. The 50.6 million U.S. visitors to the Big Apple in 2023 were 7% more than in 2022, equivalent to 95.3% of those who visited in 2019.

International travelers make up about 20% of the city’s visitors, but their return has been slower. In 2020, at the height of the pandemic amid travel restrictions, their numbers fell 82.2% to just 2.4 million. Their numbers grew to 11.6 million in 2023, an increase of 23.4% over the previous year, but down 14.1% from 2019.

Changing patterns among international travelers have affected visitor spending and the city’s tax revenue. Visitors from China, who in 2019 accounted for the largest share of total international spending in New York City, was topped by the United Kingdom in 2023 with $1.9 billion or 9% of international tourist spending in the city. In addition to a decline in the number of visitors from China, their average spending in New York city dropped from $3,000 in 2019 to $2,036 in 2023. Overall international tourism-related spending was down 20.4 percent in 2023 from pre-pandemic levels.

In both domestic and international tourism, business travel has recovered more slowly than leisure travel due in part to the impact of remote work. International business travel to the city declined from 3.4 million visitors in 2019 to about 400,000 in 2021, but has since risen to about 2.3 million in 2023.

New York city led other major U.S. tourist destinations with over 33 million overnight visitors in 2023 driven by domestic travelers. Las Vegas and Los Angeles followed with over 26 million and 21 million overnight visitors respectively. Tourism in New York city is not expected to slow down with over 39 million overnight visitors projected in 2025, compared to Las Vegas and Los Angeles at just over 29 million and 25 million, respectively. Overnight domestic visitors to the city are expected to increase by 12.9 percent from 2023 to 2025, the strongest growth among other major U.S. tourist destinations.

Despite the tourism industry’s ongoing recovery, there are still nearly 30,000 fewer workers in the sector compared to pre-pandemic levels, and the return of jobs has been uneven. Comparing 2023 to 2019, jobs in restaurants, bars, hotels and entertainment venues are still down by over 16,500 (10%) with tourism-related retail jobs down by 9,172 (16.8%). From 2019 to 2022, wages among tourism-related jobs grew more slowly than other private sector wages.

DiNapoli’s report notes that major upcoming events, including the 2026 FIFA World Cup Final, New York City’s 400th Birthday, and the 250th anniversary of the nation’s founding are expected to draw record crowds in the coming years.

Report

Tracking the Return: The Tourism Industry in New York City

Other related work

The Tourism Industry in New York City: Reigniting the Return

New York City Restaurant, Retail and Recreation Sectors Still Face Uphill Recovery

Tourism Sector Dashboard

NYC Taxable Sales and Purchases: Resilient Amid Economic Uncertainty