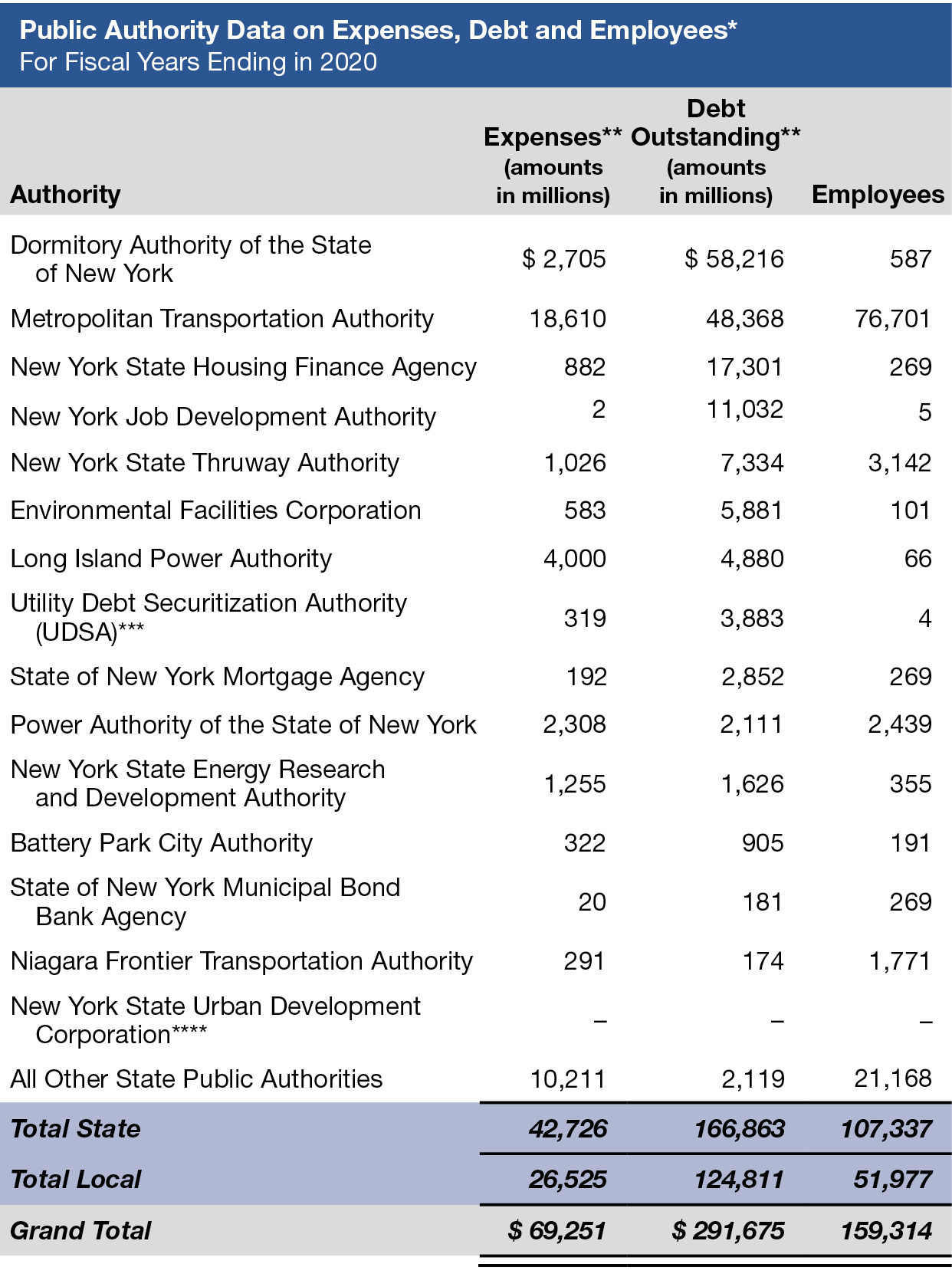

Public authorities are legally separate public entities that provide services to the public as well as to the State and local governments. New Yorkers pay for public authorities in a variety of ways including rates, tolls, fees, and in some cases, taxes. Public authorities are generally self-supporting through their revenue-generating activities; however, in some cases, governmental financial assistance and support is provided for operating and other expenses. In 2020, public authorities and subsidiaries reported more than $69 billion in revenue and capital contributions, employed more than 159,000 people, and made more than $16 billion in payments pursuant to contracts in 2020.

The fiscal stability of the State is related in part to the fiscal stability of certain public authorities closely related to the State. In 2020, public authorities reported more than $291 billion in debt outstanding. The State’s access to public credit markets could be impaired if certain public authorities closely associated with the State were to default on their obligations. In addition to issuing debt for their own purposes, public authorities issue debt on behalf of the State for which the State provides the funds for repayment.

The Enacted Budget for State Fiscal Year 2021-22:

- Increased bonding authorizations for 24 programs financed through State-Supported debt issued by public authorities;

- Added a new $1.3 billion authorization for State-Supported borrowing for the Empire Station Complex; and

- Provided for a combined increase in State-Supported public authority bonding authorizations of $22.1 billion, or 15.4 percent over previous limits.

For more information on public authorities, please see www.osc.state.ny.us/public-authorities

* The data reported are submitted by public authorities through the Public Authorities Reporting Information System (PARIS). The data contained in PARIS and used in this report are self-reported by the authorities and have not been verified by the Office of the State Comptroller. As required by Public Authorities Law, certain data submitted are required to be approved by the board of directors and/or have the accuracy and completeness certified in writing by the authority’s chief executive officer and chief financial officer. Not all authorities have complied with reporting requirements for 2020.

** Numbers may not add due to rounding.

*** Certain Long Island Power Authority (LIPA) staff are also reported as employees of the Utility Debt Securitization Authority (UDSA).

**** The New York State Urban Development Corporation has not complied with certain reporting requirements for 2020.