Purpose

The purpose of this bulletin is to inform agencies of the processing requirements for employees who claim exempt from Federal, State, and/or Local tax withholding in tax year 2021.

Affected Employees

Employees who claimed exempt from Federal, State, and/or Local tax withholding in 2020 and employees who submit withholding certificates claiming exempt in 2021 are affected.

Background

According to IRS Publication 505 (Tax Withholding and Estimated Tax) and IRS Instructions for Form W-4 (Employees Withholding Certificate), employees who claimed exempt from Federal withholding for tax year 2020 and intend to claim exemption in 2021 must file a new Form W-4 by February 16, 2021 to claim exemption for tax year 2021.

The New York State Department of Taxation and Finance requires form IT-2104-E (Certificate of Exemption from Withholding) to be filed annually by employees who claim exempt from New York State, New York City, or Yonkers withholding.

Effective Dates

Effective as of Administration paycheck dated March 3, 2021 and Institution paycheck dated March 11, 2021.

Agency Actions

The following Control-D report is available for agency use:

NPAY738 - Employees Exempt from State and Federal Taxes

This report identifies employees who claimed exempt from Federal, State, and/or Local tax withholding for tax year 2020.

Agencies must review the NPAY738 Control-D report and request a new Form W-4 and/or IT-2104-E from all employees appearing on the report.

If the employee does provide new form(s), agencies must update the employee’s Federal, State, and/or Local Tax Data pages as follows:

- Main Menu>Payroll for North America>Employee Pay Data USA>Tax Information>Update Employee Tax Data.

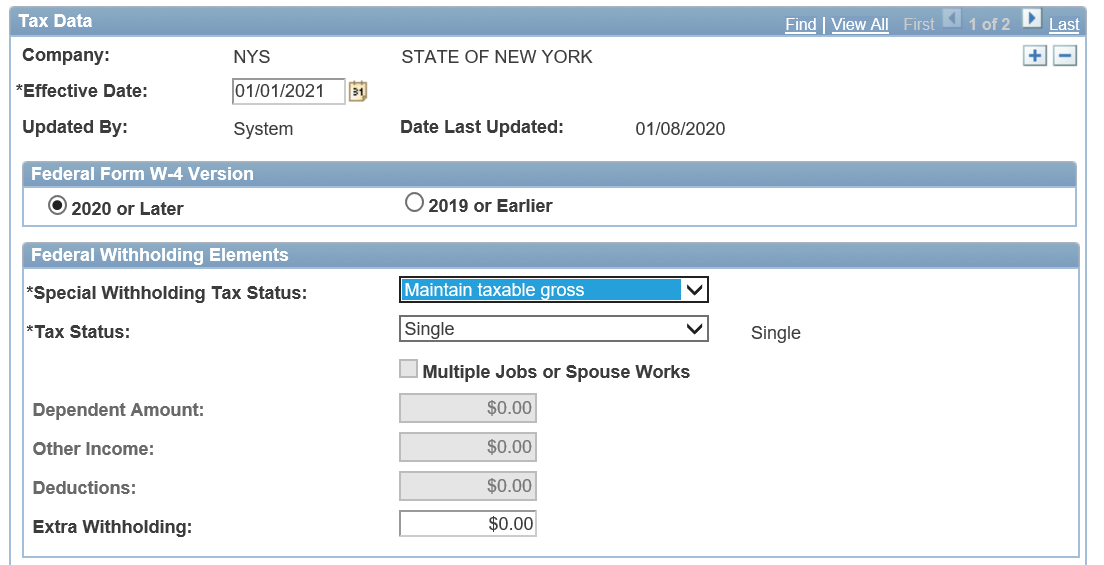

- Select the Federal Tax Data page.

- Insert a new row with a valid effective date for 2021.

- Federal Form W-4 Version should be set to “2020 or Later”.

- Under the Special Withholding Tax Status select “Maintain taxable gross”.

- All other fields should be “0” or blank (see screen shot below).

- Save the page.

- Navigate to the State and Local Tax Data pages with the same effective date as above and update the Special Withholding Tax Status to “Maintain taxable gross”.

If an employee appearing on the report does not provide a new Form W-4, begin withholding as if the employee had checked the box for Single or Married filing separately in Step 1 (c) and made no entries in Step 2, Step 3, or Step 4 of the 2020 Form W-4. The agency must update the employee’s Federal Tax Data page as follows:

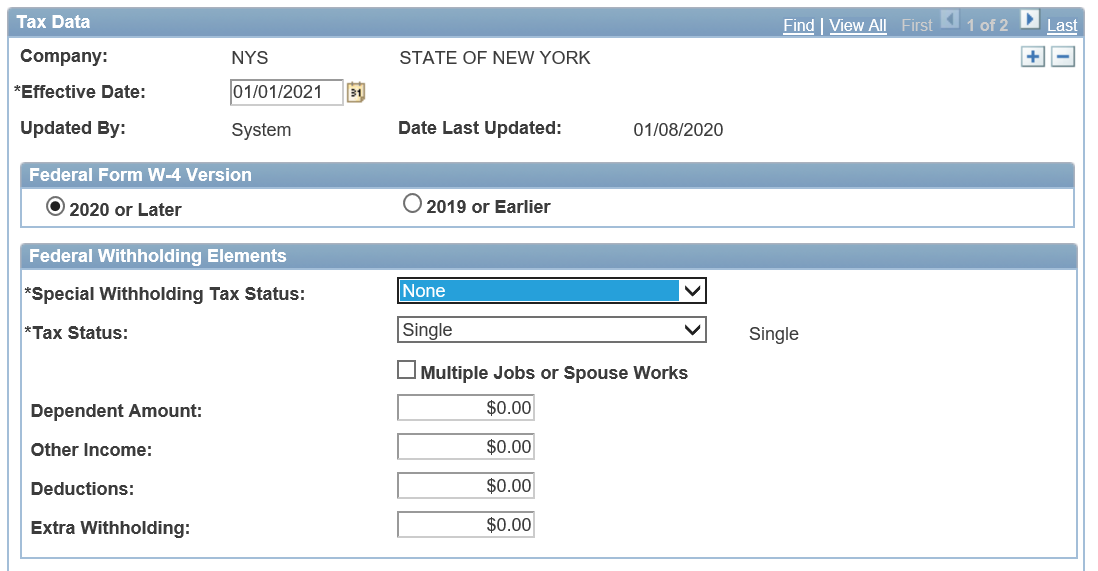

- Main Menu>Payroll for North America>Employee Pay Data USA>Tax Information>Update Employee Tax Data. Select the Federal Tax Data page.

- Insert a new row with a valid effective date for 2021.

- Federal Form W-4 Version should be set to “2020 or Later”.

- Under the Special Withholding Tax Status, select “None.”

- Set the Tax Status to “Single.”

- All other subsequent fields should be “0” or blank (see screen shot below).

- Save the page.

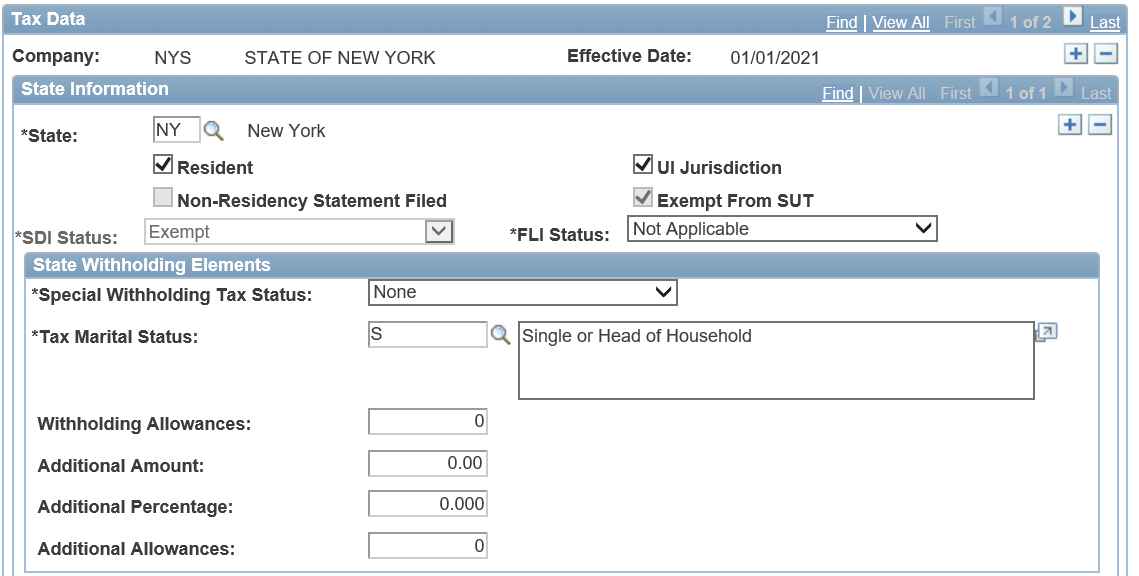

If the employee has also not submitted the IT 2104-E, update the employee’s State and Local Tax Data pages as follows:

- Navigate to the State Tax Data page with the same effective date as above.

- Under the Special Withholding Tax Status, select “None”

- Set the Tax Marital Status to “Single”

- All other subsequent fields should be set to “0” (see screen shot below).

- These same selections should be made to the Local Tax Data page, if applicable.

- Save page.

Questions

Questions regarding this bulletin may be directed to the Tax and Compliance mailbox.