Retirement may be far in the future, but the steps you take now—especially when saving for retirement—can have a huge impact on your later years and your financial security during retirement.

Sources of Retirement Income

Think of retirement security as a three-legged stool with three sources of income working together to help support you when your working days are done:

- Your NYSLRS pension is a defined benefit plan, also known as a traditional pension plan. When you retire, you will receive a monthly pension payment for the rest of your life.

- Your Social Security benefit is another source of income to help support you in retirement.

- Your retirement savings is the third leg of the stool which can provide additional financial security and flexibility during retirement.

Start Saving Early So Your Money Has Time to Grow

It’s important to start saving as early in your career as you can so your money has time grow—or compound.

When you invest your savings in an individual retirement account (IRA) or a 401(k)-style retirement savings plan, you earn a return on your investment. With the power of compounding interest, both your initial investment and your return on investments compound—meaning your money increases in value by earning returns on both the original amount and your accumulated profits.

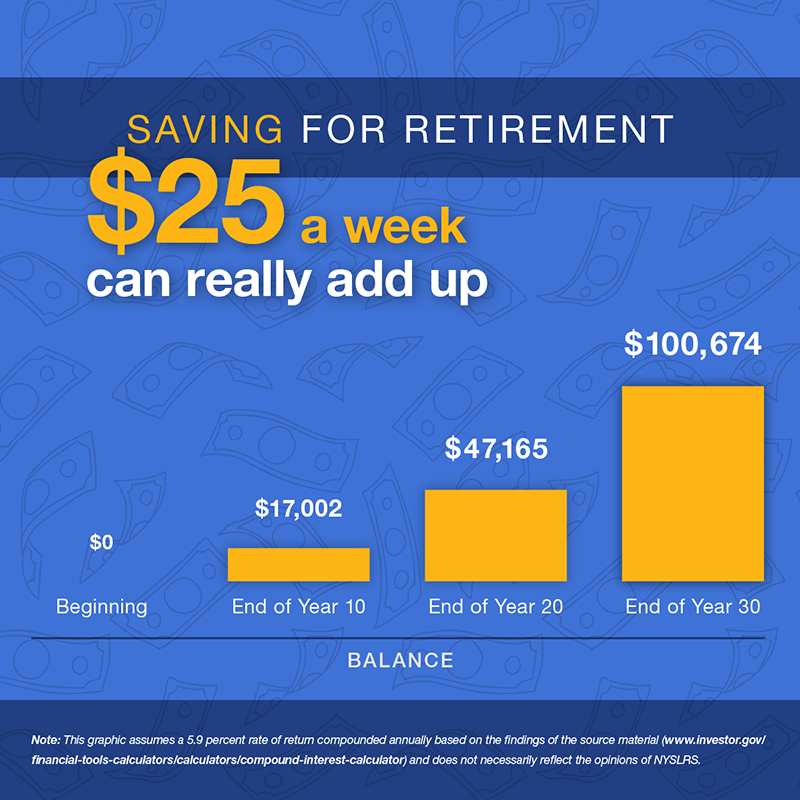

The following graphic shows the potential results of saving and investing $25 a week over 30 years using a conservative 5.9 percent annual rate of return. (The historical average annual rate of return on stocks is about 10 percent.) You can use a retirement savings calculator to see how much your savings could yield over time, or test the results of saving different amounts.

Ways to Save

State workers and employees of participating school districts and local government employers can enroll in the New York State Deferred Compensation Plan (NYSDCP) and start saving for retirement with as little as $10 automatically deducted from each paycheck. NYSDCP offers a variety of quality investment options to help you reach your retirement goals, including both traditional pre-tax and Roth 457(b) accounts.

If you’re not eligible for NYSDCP, check with your human resources office or benefits administrator to learn what retirement saving plans are available through your employer. Banks or other financial institutions, such as insurance companies and investment firms, also offer retirement savings plans.

Types of Savings Accounts

With your retirement savings, you get to decide how much to save and how to invest it.

- With a traditional pre-tax account, tax is deferred so you won’t pay income tax on your contributions until you start withdrawing money in retirement.

- With an Individual Retirement Arrangement (IRA), your contributions can be fully or partially tax-deductible.

- With a Roth IRA, your taxes are not deferred on the amount you deposit, but, if you satisfy certain requirements, qualified distributions are tax-free.

How Much to Save

Because you have a pension, you may not need to save as much as someone relying only on a 401(k)-style retirement savings plan. So if you’re just starting your career, you may want to pick an amount or percentage of your earnings you’re comfortable with to see the impact on your paycheck. Then, consider increasing your contributions—even a small increase can make an impact over time. NYSDCP’s paycheck impact calculator may be a helpful tool to see how changes to your contributions may affect your take-home pay.

Rev. 1/26