Admin

2022 Financial Condition Report

For Fiscal Year Ended March 31, 2022

2022 Financial Condition Report

For Fiscal Year Ended March 31, 2022

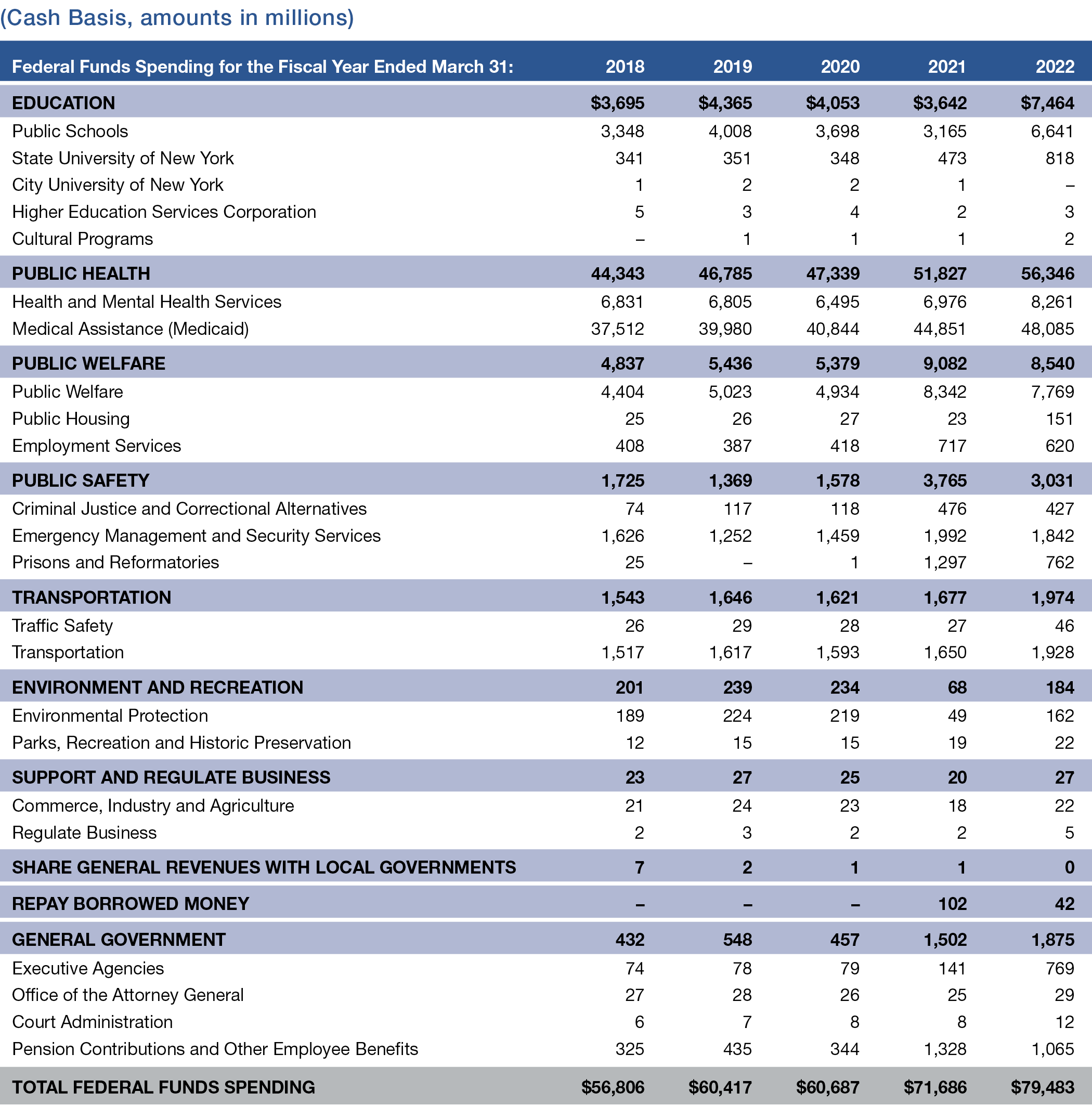

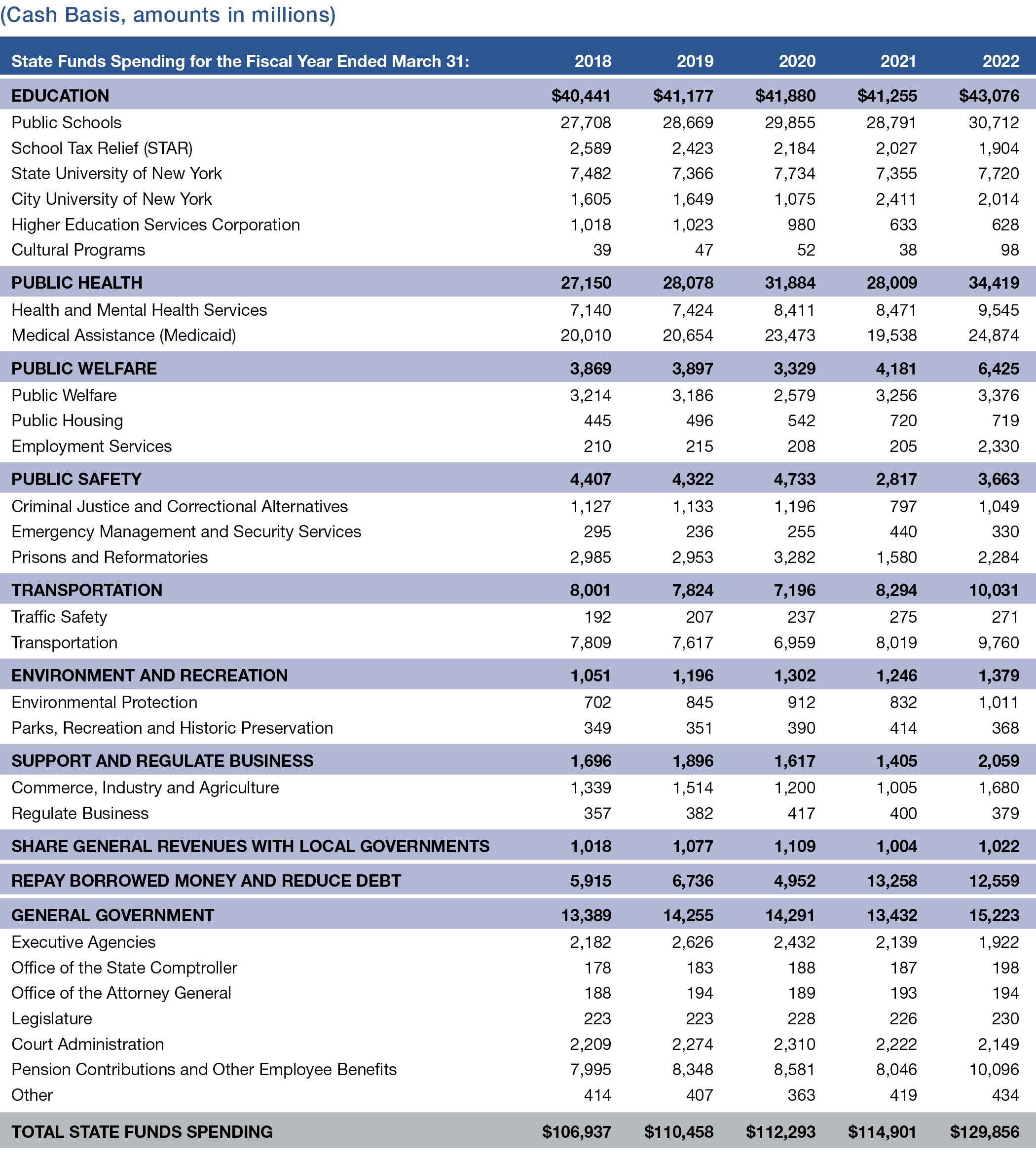

Appendix 1: State Funds Spending by Major Function

2022 Financial Condition Report

For Fiscal Year Ended March 31, 2022

Implications for the Future

The Economic Outlook: Uncertainty Remains

As the world faced the third year of the COVID-19 pandemic, its impact on the economy continued to be felt and was heightened by other factors, such as the Russian invasion of Ukraine. Supply chain disruptions, increased demand of goods, and a tight labor market pushing wages higher combined to boost inflation to its highest level since the early 1980s, causing the Federal Reserve Board to aggressively raise interest rates by 225 basis points between January and August 2022.

2022 Financial Condition Report

For Fiscal Year Ended March 31, 2022

Taxes

State Tax Collections Increased Significantly in SFY 2021-22 from $82.4 Billion to $121.1 Billion

- In SFY 2021-22, reported New York State tax collections increased by 47 percent, primarily reflecting the economic recovery as well as temporary tax rate increases included in the SFY 2021-22 Enacted Budget.

- Personal income tax (PIT) collections grew by 28.6 percent due, in part, to the increase in tax rates for those with incomes over $1.1 million (the top tax rate equal to 10.9 percent for incomes over $25 million).

- PIT collections also benefited from a

2022 Financial Condition Report

For Fiscal Year Ended March 31, 2022

Economic and Demographic Trends

Employment Statewide Recovering Slowly in 2021

- In calendar year 2021, the State gained over 226,000 jobs, an increase of 2.6 percent compared to growth nationally of 5.6 percent.

- Employment in the State was still 7.6 percent lower than that in 2019.

- The State’s unemployment rate fell from 9.9 percent in 2020 to 6.9 percent in 2021.

- The leisure and hospitality sector, the hardest hit industry during the pandemic, realized the largest job gains in 2021, 13.6 percent.

2022 Financial Condition Report

For Fiscal Year Ended March 31, 2022

Public Authorities

Public authorities are distinct legal entities that provide services to the public as well as to the State and local governments. New Yorkers pay for public authorities in a variety of ways including service charges, tolls, fees, and in some cases, taxes. Public authorities are generally self-supporting through their revenue-generating activities; however, in some cases, governmental financial assistance and support is provided for operating and other expenses.

2022 Financial Condition Report

For Fiscal Year Ended March 31, 2022

Debt

The debt burden of a governmental entity creates fixed costs that directly affect its ability to provide current services, as well as its long-term fiscal health. High borrowing levels may:

2022 Financial Condition Report

For Fiscal Year Ended March 31, 2022

Local Government

Major Local Revenue Sources Remained Fairly Stable

- Real property tax revenues were mostly unaffected by COVID-19 in local fiscal years ending (LFY) in 2020.

2022 Financial Condition Report

For Fiscal Year Ended March 31, 2022

Higher Education

Enrollment

- In academic year (AY) 2021-22, New York State public and private higher education institutions had 794,701 full-time and 340,884 part-time students in degree-credit enrollments.

- Full-time equivalent (FTE) enrollment at public institutions decreased in AY 2020-21 by 8.5 percent compared to five years earlier and by 11.5 percent compared to 2011-12.

2022 Financial Condition Report

For Fiscal Year Ended March 31, 2022

Elementary and Secondary Education

Significant Federal Aid Continues to Support New York Schools

- According to the Division of the Budget, schools have received or are slated to receive $15.3 billion from various federal aid programs, including $1.6 billion from the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), $4.4 billion from the Coronavirus Response and Relief Supplemental Appropriations Act (CRRSA Act), and $9.3 billion from the American Rescue Plan Act (ARP Act).