Overview

Your annual invoice is provided at the beginning of November. If you have the Billing Security Role, we notify you when your invoice is available in Retirement Online.

Payment for your annual invoice is due by February 1, 2026. Since this due date falls on a Sunday, we will consider the following on time:

- ACH or wire transfer payments received on or before February 2, 2026.

- Checks sent by certified mail and postmarked on or before February 2, 2026.

- Checks not sent by certified mail and received on or before February 2, 2026.

Or you have the option to pay a discounted prepayment amount by December 15, 2025.

If we do not receive your payment on time, the unpaid balance of your invoice will accrue daily interest at a rate of 5.9 percent.

Viewing Your Annual Invoice

- Sign in to Retirement Online.

- From Account Homepage, click Access Billing Dashboard button.

- After choosing location code and retirement system (ERS or PFRS), click Annual Invoice link.

Your current annual invoice will remain available in Retirement Online until next summer when we release your estimate for the invoice due in 2027. At that time, your current annual invoice will move to your previous years’ invoices. You can view past invoices going back to 2013 by clicking the Previous Years’ Annual Invoices link on the Billing Dashboard.

Only employees with the Billing Security Role are able to access the Billing Dashboard. Your Security Administrator assigns this role to contacts who need to view billing information.

Understanding Your Annual Invoice

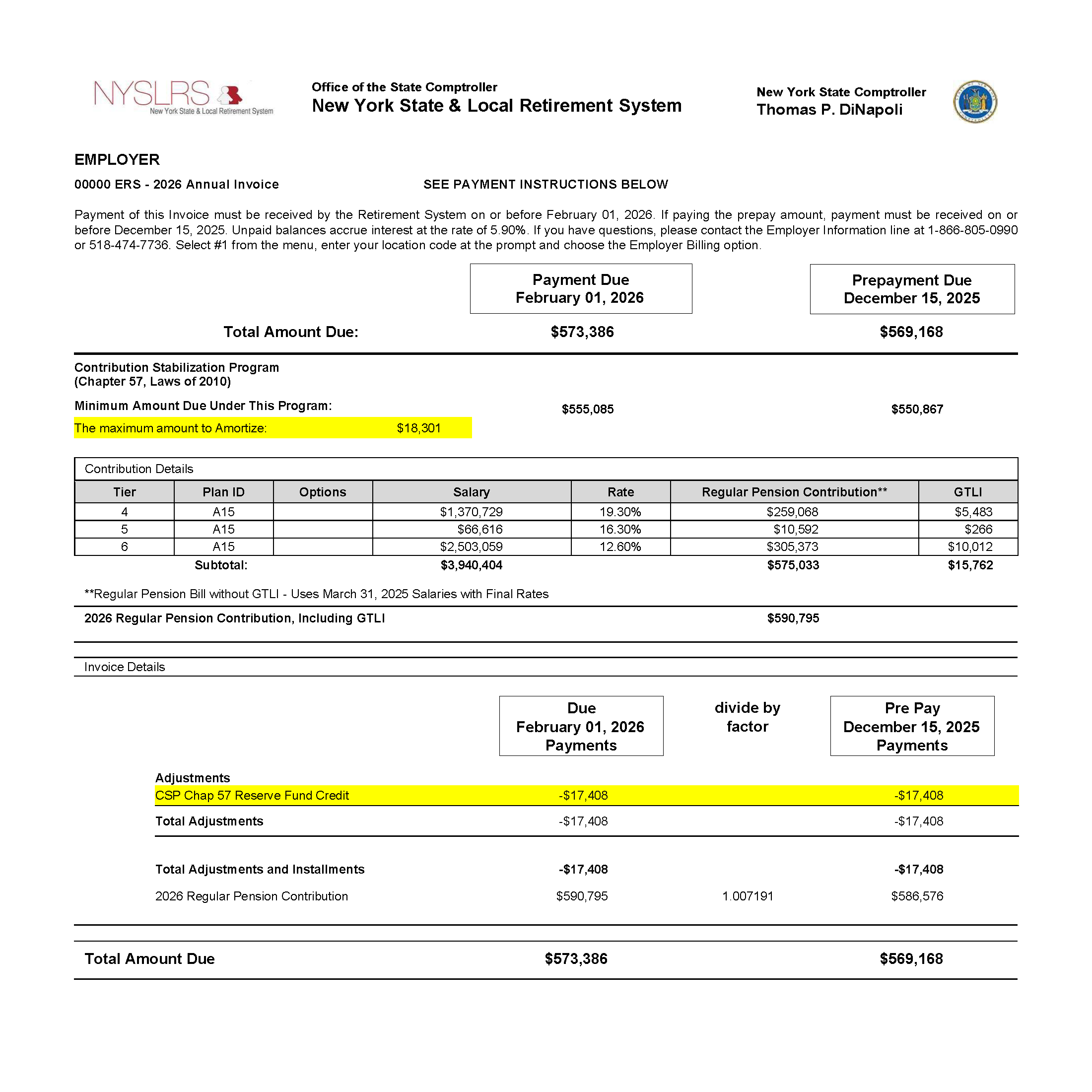

Your annual invoice is calculated using the employee earnings reported to NYSLRS by your organization during State Fiscal Year, April 1, 2024–March 31, 2025 (SFY 2024-25). To view the Fiscal Year Earnings used to calculate your invoice, click the Billed Data link on the Billing Dashboard.

Plan ID and Options

Plan ID refers to the retirement plan.

Options are additional benefits beyond those offered in the standard plans, which you chose to provide to your employees. For example, options 41J and 341J refer to Sections 41(j) and 341(j) of the Retirement and Social Security Law (RSSL), which allow members to receive additional service credit for their unused, unpaid sick leave at retirement.

Salary, Rate and Regular Plan Contribution

For each retirement plan (Plan ID) and the additional benefits offered (Options):

- The Salary refers to the earnings reported for your employees.

- The Rate refers to the actuarially determined cost shown as a percentage.

- The Regular Pension Contribution refers to your required employer contribution (the amount you’re required to pay), which is calculated by multiplying the Salary by the Rate.

Employer contribution rates are determined annually to ensure proper funding for the Common Retirement Fund, which holds and invests the money used to pay for your employees’ retirement benefits. Contribution rates are issued by system and broken down by tier and retirement plan.

- Employer Contribution Rates for ERS Retirement Plans

- Employer Contribution Rates for PFRS Retirement Plans

Group Term Life Insurance (GTLI)

GTLI provides ordinary death benefits for your employees. The cost is listed separately from the Regular Pension Contribution because it is excluded from the calculation of the amount to amortize.

Adjustments and Installments

Adjustments represent charges or credits associated with the current or prior fiscal years.

- Adjustments to earnings for SFY 2024-25 must have been submitted by May 31 to be included in your invoice.

- Adjustments to earnings for previous fiscal years, known as Prior Years’ Adjustments, must have been submitted by March 31 to be included in your invoice.

Installments include amortization payments, past service costs and deficiency contributions.

Divide by Factor

The Divide by Factor refers to a divisor used to calculate the discounted prepayment amount due by December 15, 2025. The divisor is based on the current interest rate of 5.9 percent, which is determined by the assumed rate of return on investments.

| Calculation: | Invoice Amount | ÷ | Divide by Factor | = | Pre-Payment Amount |

|---|---|---|---|---|---|

| Example: | $90,616,790 | ÷ | 1.007191 | = | $89,969,817 |

Paying the discounted prepayment will save you money. Using the above example:

| Calculation: | Invoice Amount | - | Pre-Payment Amount | = | Savings |

|---|---|---|---|---|---|

| Example: | $90,616,790 | - | $89,969,817 | = | $646,973 |

When Graded Payments are Required or When You Can Amortize

The Contribution Stabilization Program (CSP) and Alternate Contribution Stabilization Program are optional programs, which allow you to pay a portion of your annual invoice when due and pay the remainder over time with interest.

These programs use a graded contribution rate system set by law. Each year, NYSLRS (the System) establishes the System average rate and the System graded rate.

As the System average rate trends upward or downward, the System graded rate follows.

- Under the CSP, the System graded rate may change by up to 1 percent.

- Under the Alternate Program, the System graded rate may change by up to 0.5 percent.

NYSLRS uses the System graded rate to determine an employer’s graded rate, which is then compared to their normal annual contribution rate to determine whether they are required to make a graded payment or eligible to amortize.

When your normal annual contribution rate is lower than your graded rate, you are required to make a graded payment to offset future increases in your graded rate. In this circumstance, your invoice provides the required Employer Graded Payment under the Adjustments section. This payment is applied to any outstanding amortizations (oldest to newest), and the remaining balance is deposited into your Reserve Fund, which earns interest.

When your normal annual contribution rate is higher than your graded rate, you are eligible to amortize a portion of your invoice. In this circumstance, your invoice provides the maximum amount to amortize. In some cases, this may be less than expected or $0, because if you had a Reserve Fund balance, a CSP Chap 57 Reserve Fund Credit is applied to your invoice which reduces both the total amount due and the amount you can amortize. If your Reserve Fund contained more funds than could be applied to your invoice, there will be a remaining balance.

To view your updated balance, click the Reserve Fund Balance link on the Billing Dashboard. Your invoice does not provide this information.

Paying Your Annual Invoice

You can pay your annual invoice by automated clearinghouse (ACH), wire transfer or paper check. ACH is the preferred method of payment for employers to transfer money to NYSLRS.

ACH is the Best Way to Pay

Paying by ACH is:

- Fast. Your funds are transferred electronically.

- Easy. Your payment comes directly to us, eliminating unnecessary handling by mailrooms, post offices, staff, etc.

- Secure. It’s the same system used by banks and other financial institutions.

- Reliable. It helps ensure your payment is received on time and more dependably than mailing checks.

Notify NYSLRS Billing Before Paying

Regardless of which payment method you choose, before making your payment, you must email [email protected] the following information:

- Employer name

- Employer location code

- Retirement system (ERS or PFRS)

- Payment amount

- Date of payment

Pay by ACH or Wire Transfer

- ACH and wire transfers are both secure, electronic ways to transfer funds and more reliable than mailing a check. However, payments made by ACH are less costly than wiring money.

- You must set up the ACH or wire transfer payment directly with your bank or a money transfer provider.

- The ABA routing number and account information you need to set up your payment is at the bottom of your invoice.

- If paying by wire transfer, you must include your employer location code and the retirement system (ERS or PFRS) in the Wire Description.

- The close of business for ACH and wire transfer payments is 3:00 pm. Payments received after 3:00 pm will be credited on the next business day.

- An ACH or wire transfer payment can take up to 2 business days to process. It’s important to check with your bank or wire transfer provider on the timing if you’re not familiar with the process.

Pay by Paper Check

- Make the check payable to the New York State and Local Retirement System.

- Fill out the payment slip provided with your invoice and include the following information:

- Employer name

- Employer location code

- Retirement system (ERS or PFRS)

- Payment amount

- Date of payment

- Mail the check and payment slip to:

Attn: Remittance/Billing

NYSLRS

110 State St 2nd Floor

Albany, NY 12244-0001

- If you use certified mail, we will consider your payment received on the date your check was mailed (postmarked).

- If you don’t use certified mail, we will consider your payment received on the date we physically receive your check.

If You Need Help

If you have questions about your annual invoice or for help accessing Retirement Online, use our help desk form (select Employer Billing or Retirement Online Troubleshooting from the dropdown).

You can also call 866-805-0990 (press 1 to access the employer menu, then follow the prompts).

Rev. 11/25