The New York State Common Retirement Fund (the Fund) holds and invests the money used to pay NYSLRS benefits. As the trustee of the Fund, New York State Comptroller Thomas P. DiNapoli is responsible for the Fund’s performance, oversight and management.

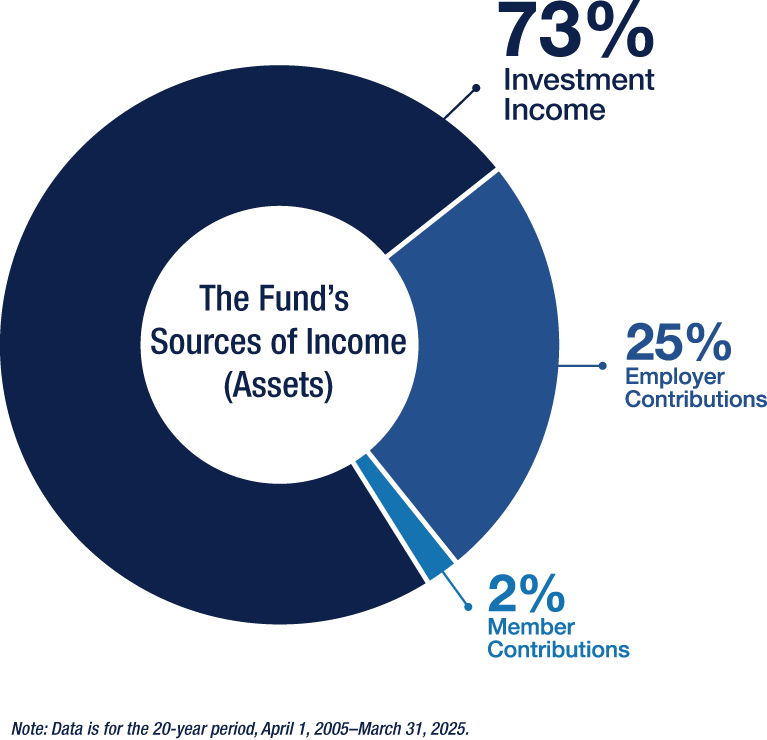

The Fund, which was valued at $273.1 billion as of March 31, 2025, has three main sources of income (assets):

- Investment income

- Employer contributions

- Employee (member) contributions

Over the past 20 years, approximately $219.3 billion was paid in pension benefits and the Fund’s investment income covered 73 percent of the cost. Over this same period, employer contributions represented 25 percent of the Fund’s assets and employee (member) contributions represented 2 percent.

For more information, read about the Comptroller’s responsibilities and the Fund’s mission, values and investment philosophy.

Rev. 9/25