SECTION OVERVIEW AND POLICIES

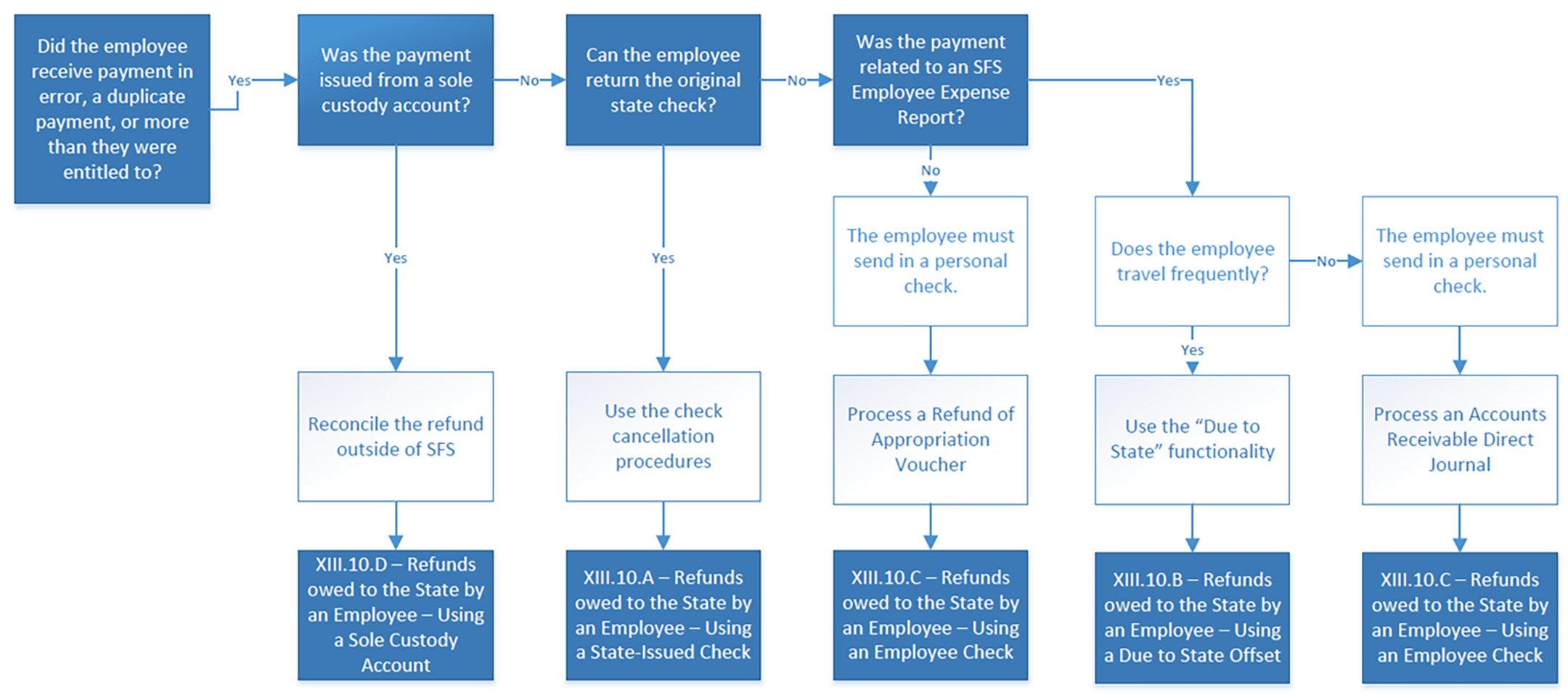

This section provides Agencies with guidance on how to process a refund owed to the State by an employee. Situations where an employee owes a refund to the State may occur for various reasons. For example, an employee may have (i) received a duplicate payment, (ii) been paid in error, (iii) received an amount greater than they were entitled to, or (iv) spent more on the State-issued travel card than he or she was entitled to receive in reimbursement on the employee expense report.

When an employee owes the State a refund as the result of an employee expense report, the employee may use the Due to State Offset functionality in SFS or submit a personal check to the Agency to refund the amount.

Agencies must monitor refunds owed to the State by employees by running public query: DTS_ERS_DTS_OFFSETS – Due to State Expense Reports. If an employee owing a refund to the State does not frequently submit expense reports, agency officials should ensure monies are repaid to the State by check.

- 10.A – Refunds Owed to the State by an Employee – Using a State-Issued Check

- 10.B – Refunds Owed to the State by an Employee – Using a Due to State Offset

- 10.C – Refunds Owed to the State by an Employee – Using an Employee Check

- 10.D – Refunds Owed to the State by an Employee – To Agency Sole Custody Account

Guide to Financial Operations

REV. 10/01/2025